File Private Foundation Tax Return 990-PF Online

- Interview Style Filing Process

- Supports current (2025) & Prior Years (2024, 2023)

- Automatic Schedules & Worksheet

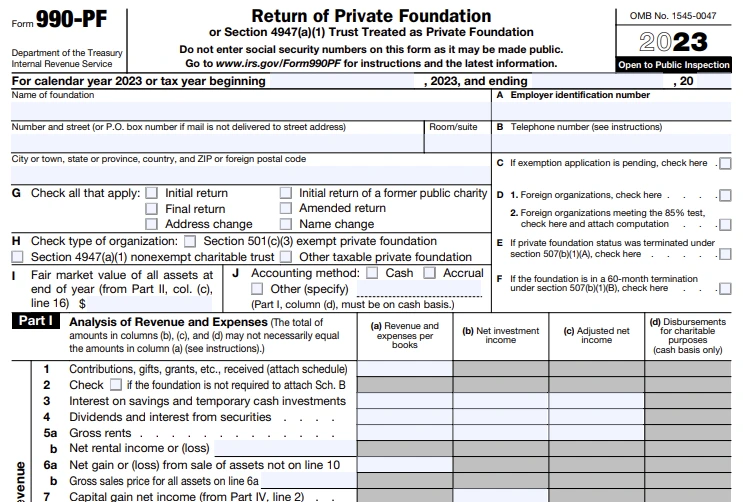

Private Foundation and Form 990-PF - An Overview

A private foundation is a charitable corporation or trust which receives financial support from a limited number of sources. Private Foundations need to file their annual tax returns with the IRS.

Form 990-PF is filed by Exempt & Taxable Private Foundations and also by Non-exempt Charitable Trusts whom the IRS treats as private foundations.

Due Date to File 990-PF Form

Form 990-PF should be filed by the 15th day of the 5th month after the close of the organization’s accounting period.

If your organization operated on calendar tax year, then deadline is

May 15.

Now if the regular due date is on a Saturday, Sunday or legal holiday, you need to file the next day.

What Informations Private Foundations Need To File with Form 990-PF?

Private foundations need to file the Form 990-PF online with the follow-

- To provide the details of the assets.

- To give a brief description of the financial activities.

- To provide the details of the trustees and officers.

- To display the entire list of the grants that were given in the specific fiscal year.

File990pfonline.com - The Best Solution to File 990-PF Forms Online

If you are looking for a simple and easy method to e-file 990-PF form, then the File990pfonline.com is the best one. It provides a stress-free and simplified process of preparing as well as filing your required 990 Forms along with the necessary schedules. Now the schedules will be automatically generated based on the details that you have provided while preparing your 990 Forms with File990pfonline.com.

Features

Amended Returns

You can correct the previously filed IRS Form 990-PF quickly and easily with our amended returns feature.

990 Schedules

Our simplified e-filing software supports all the schedules of the Form 990 series and these get auto-generated while e-filing your 990 forms.

Interview Style Preparations

With our e-filing software, you get a step-by-step process and helpful prompts that can easily guide you right from the start to finish.

Approvers & Reviewers

Various users who are a part of your organization’s governing body can edit as well as recheck the prepared return using File990pfonline.com. Your 990 forms will be verified before it is transmitted to the IRS, along with the digital signature.

Internal Audit

The internal audit check will make sure that you are transmitting an error-free 990 tax returns to the IRS. This internal audit check is done to avoid getting your return rejected.

Prior Year Support

With File990pfonline.com you have the option to easily file the current (2025) as well as prior year (2024, 2023) returns. Not only it is simple but quite easy too.

Premium Support

If you are in need of any assistance for filing your 990 return, then don’t worry. Our team of expert and experienced tax e-filers will always be there to assist you through the process.

US Based Support

If you are curious about certain things about our software, you can talk with our 100% US-based customer support team members from Monday to Friday, 9 AM to 6 PM EST.

How to File 990-PF Form Online with file990pfonline.com?

Preparing, and filing your Form 990-PF of your private foundation can be done in simple 5 steps -

- Sign in or create the free account

- Add the details of your organization

- Complete the form interview process

- Review the information added and check the audit report

- Make the payment and transmit directly to the IRS.

Get More Time to File Form 990-PF Online with the IRS

Do you want more time to e-file your Form 990-PF? Don’t worry!

You can get an automatic 6-month extension by filing Form 8868. Private organizations can get additional time for filing Form 990-PF by filing IRS Form 8868 before or on the original filing deadline of the organization.Within minutes you will immediately get an additional six-month extension for filing your 990-PF online.

Penalties for not filing form 990-PF on time

The penalty generally is 1/2 of 1% of the unpaid tax for each month or part of a month the tax remains unpaid. This does not exceed to 25% of the unpaid tax. If there is a reasonable cause for not paying your taxes on time, then the penalty will be waived off.

Pricing to file 990-PF online

Check out the budget-friendly prices for filing your Form 990-PF. You can file a 990-PF return at $169.90

Other supported Forms

We also support the below forms -

- Form 990-N

- Form 990-EZ

- Form 8868

- Form 8038-CP

- Form 990

- Form 990-T

- CA Form 199

- Form 1120-POL